APAC regions fastest growing set of countries as per American Express Global Business Travel releases Air Monitor Report 2019

- January 23, 2019

American Express Global Business Travel has published Air Monitor 2019 – a comprehensive report that outlines key factors and indicators that will affect air travel in 2019.

The report finds that fare levels should remain stable on many of the world’s major air routes in 2019. Capacity and growing competition, including new low-cost carriers on long-haul routes, will likely restrain fare rises on key routes from Europe and Asia-Pacific, even as the global economy is forecast to grow and airlines face rising operating costs. However, current economic and political uncertainties and developments may impact the forecast.

Asia-Pacific region will still see strong growth amongst the overall dull conditions and slower growth across China and India.

Asia-Pacific

- Despite expecting both India and China to grow at a slower pace in 2019, a forecast growth rate of 6.3% still makes the Asia-Pacific region the fastest growing set of countries.

- The outlook for fares across the Asia-Pacific is stable, supported by the strong economies of India, China and Australia.

- Fares are likely to reduce in price across Hong Kong, Japan and Singapore due to the impact of financial sector slowdown and the loss of premium class traffic.

Australia

- Due to high commodity prices the Australian economy is expected to grow by 3.7% in 2019, keeping air travel results strong in the region.

- Threats to this growth include the China-US trade war as well as the decline in the Australian housing market.

- Strong competition from international airlines, particularly those flying to Europe, is keeping prices steady.

- Qantas will continue to offer its point of difference service between Perth and London (non-stop) with the intention on introducing a non-stop service from Melbourne to New York.

India

- India is the fastest-growing G20 economy, forecast to expand by 7.4% in 2019. Investment and exports, supported by the implementation of the new goods and services tax, means that strong air travel results will continue.

- A fare decline is expected on Middle Eastern routes. Overcapacity is the primary reason for the expected price fall.

- The Indian air travel marketplace is expected to overtake Germany, Japan, Spain and the UK in terms of size within the next 10 years.

- Infrastructure remains a key issue in India with major airports at or near capacity. India’s airlines have more than 1,000 aircraft on order, indicating that infrastructure cannot keep pace with the current growth.

Singapore

- Singapore’s economic outlook remains positive, despite global trade risks. GDP is projected to grow by 2.5% in 2019. Despite the growth, a slight reduction in fare price is expected due to the impact of financial sector slowdown.

- The 2017 merger between Scoot and Tigerair has created a strong player at the budget end of the regional business. However, business travel is still very reliant on Singapore Airlines who continue to be a major presence in the region.

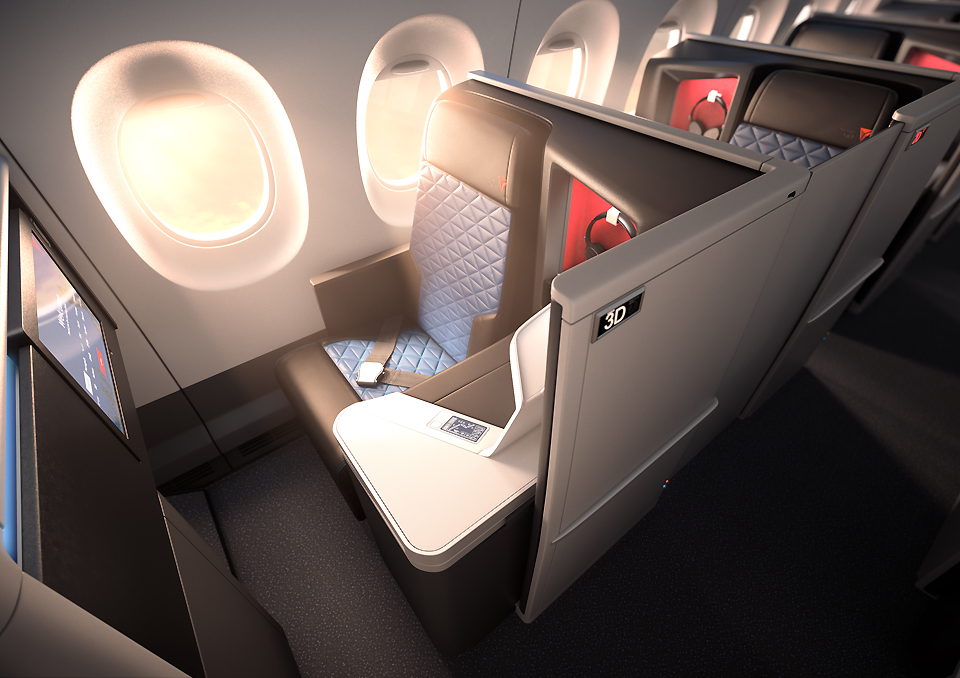

- Singapore Airlines has also made a significant investment in Premium Economy, a product that is not often available in Singapore. The carrier now offers premium economy seats in almost 60% of its total fleet and is slated to add another 11 premium economy aircraft. The increase in premium economy bookings has not come at the expense of business class bookings, which have remained steady.

Key Takeaways for Travel Buyers

BOOK EARLY: the earlier you book the lower the fare, the better the choice of carrier and even the seat. Where possible booking two weeks and more in advance can significantly reduce costs, for example, booking domestic and regional fares more than two weeks in advance can save up to 30%, and up to 10% on international flights.

REGIONAL AIRPORTS: utilize a regional airport if practical. These are often cheaper than larger city airports because of lower landing charges. Airlines often want to grow their volumes through regional airports. This is a good opportunity to drive real savings and enhance the business relationship with these airlines.

TOTAL COST FOR TRAVEL: think about all the costs involved in a trip, including travel costs to the airport and airport parking, keep these costs in mind when you book.

DIRECT VS INDIRECT: using indirect routes when fares are lower and departure and connecting times make sense is a good option. But take advice on factors such as time needed for clearing US immigration to catch a connecting flight. Optimizing your air program: top tips and best practices.

USE TECHNOLOGY AND KEEP SHOPPING: there are a number of systems available that let you take advantage of price drops after a ticket is booked. These tools constantly monitor prices on booked air tickets and if a lower price becomes available, the system alerts you and can automatically rebook and reissue a ticket, saving you money.

WHEN TO FLY: identify the prime travel times on your key routes: for example, traveling on a Friday in the UK is typically more expensive than flying Monday to Wednesday. Avoiding international flights on a Sunday and Monday can reduce costs and avoid travellers losing part of their weekend –important for traveller wellbeing. Consider how major events in destination cities can drive up fares: your pricing strategy should include internal blackout periods when all but essential travel is blocked to cities hosting events.

For a full copy of American Express GBT Air Monitor 2019, email the Editor; harmeet@businesstraveller.co.nz with your name, organisation and title.